Should NPOs Follow International Standards for Financial Reporting? A Multinational Study of Views

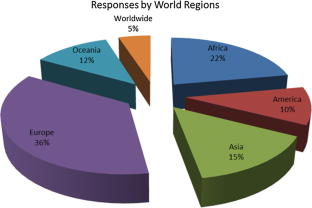

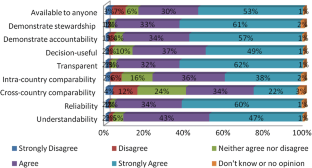

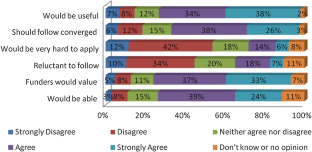

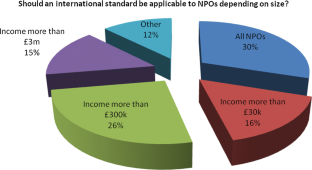

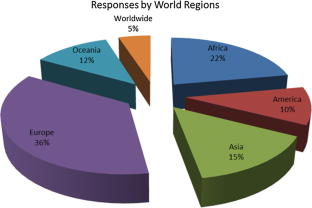

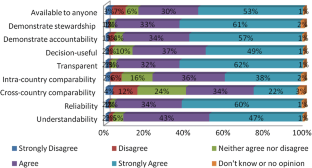

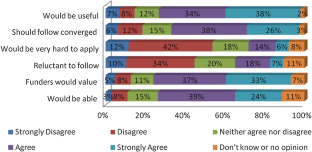

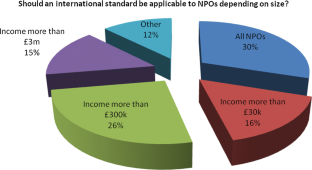

Financial reporting is an important aspect of not-for-profit organisations’ (NPOs’) accountability. Globally, numerous and varying regimes exist by which jurisdictions regulate NPO financial reporting. This article explores whether NPOs should be required or expected to follow sector-specific international financial reporting standards. We investigate stakeholder perceptions on the nature and scope of any such developed standards, interpreting our findings through the lens of moral legitimacy. Using an international online survey of stakeholders involved in NPO financial reporting, we analyse 605 responses from 179 countries. Based on our findings, we argue that diverse stakeholder groups, especially those who are involved with NPO financial reporting in developing countries, are likely to grant moral legitimacy to developed NPO international accounting standards if the consequences are to enhance NPO accounting and accountability information, subject to agreement as to whether all or only NPOs of a certain size should comply and whether any such standards should be mandatory.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save

Springer+ Basic

€32.70 /Month

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Buy Now

Price includes VAT (France)

Instant access to the full article PDF.

Rent this article via DeepDyve

Similar content being viewed by others

In Pursuit of a ‘Single Source of Truth’: from Threatened Legitimacy to Integrated Reporting

Article 04 September 2015

Government Accounting Standards and Policies

Chapter © 2013

Romania. Shifting to IFRS: The Case of Romania

Chapter © 2016

Notes

The subtleties of legitimation are presented here as distinct explanations as to why stakeholders might grant legitimacy to a particular financial reporting practice. In reality, pragmatic, moral and cognitive legitimation processes are not clearly separable, but often interact and reinforce each type of legitimation. (Georgiou and Jack 2011; O’Dwyer et al. 2011).

It is of interest to note that IFRS Trustees have announced that, although they will support efforts to develop NPO standards, they will not be responsible for developing them (IFRS Foundation 2016).

The scope and dimensions of NPO accountability have been the subject of extensive research to date with scholarly contributions proposing both broad and narrower frameworks of NPO accountability. It is beyond the scope of this paper to develop a detailed discussion of this broader issue, but readers are further referred to the seminal contributions of Gray et al. (2006), Ebrahim (2005) and (2009) in this regard.

IASB does not have legislative power; however, over 140 jurisdictions have mandated, through jurisdictional regulatory frameworks, IFRS for publicly accountable companies.

Many national standard setters also undertake similar due process work to ensure “buy-in” from their constituency and the quality of their standards (for an example from the Third Sector, see Sinclair and Bolt 2013).

The full survey can be found at Crawford et al. (2014b), Appendix B..

Empirical data available from Crawford et al. (2014b).

Of necessity, it would take many years to enshrine such a requirement in the legislation of countries around the world, even if it were considered desirable, but it could be that reputational pressures or the desire for accreditation against particular standards in order to attract funding might be enough to persuade NPOs to comply.

References

- ACCA (Association of Chartered Certified Accountants). (2015). Companion guide for not-for-profits to the international financial reporting standard for small and medium-sized entities (IFRS for SMEs) (pp. 4–6).

- Anheier, H. K. (2014). Nonprofit organizations: Theory, management, policy. Abingdon: Routledge. BookGoogle Scholar

- Ashford, K. (2007). Accountability, reporting and ethics by NGOs: A UK perspective. Paper presented to the NGO Accounting Conference, Uganda.

- Berger, T. M. M. (2009). IPSAS explained. Chichester: Wiley. Google Scholar

- Biraud, G. (2010). Preparedness of United Nations System Organizations for the international public sector accounting standards. Geneva. Retrieved from https://www.unjiu.org/en/reports-notes/JIUProducts/JIU_REP_2010_6.pdf. Accessed July 2018.

- Black, J. (2008). Constructing and contesting legitimacy and accountability in polycentric regulatory regimes. Regulation & Governance,2(2), 137–164. ArticleGoogle Scholar

- Breen, O. (2013). The disclosure panacea: A comparative perspective on charity financial reporting. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations,24(3), 854–880. ArticleGoogle Scholar

- Breen, O., Ford, P., & Morgan, G. (2009). Cross-border issues in the regulation of charities: Experiences from the UK and Ireland. International Journal of Not-for-Profit Law,11(3), 5–41. Google Scholar

- Brusca, I., Montesinos, V., & Chow, D. (2013). Legitimating international public sector accounting standards (IPSAS): The case of Spain. Public Money & Management,33(6), 437–444. https://doi.org/10.1080/09540962.2013.836006. ArticleGoogle Scholar

- CCAB (Consultative Committee of Accountancy Bodies). (2013). Research on international financial reporting for the not-for-profit sector—Terms of Reference for the project steering and advisory group.https://www.ccab.org.uk/documents/20130429_Terms_of_reference_FINAL.pdf. Accessed July 2018.

- Charity Commission for England and Wales. (2017). Registered charities by income band Sept 2017. https://www.gov.uk/government/publications/charity-register-statistics/recent-charity-register-statistics-charity-commission. Accessed July 2018.

- Charity Commission & OSCR (Office of the Scottish Charity Regulator). (2014). Charities SORP (FRS 102)—Accounting and reporting by charities: Statement of recommended practice applicable to charities preparing their accounts in accordance with the financial reporting standard applicable in the UK and Republic of Ireland (effective 1 January 2015). London: CIPFA.

- Chasin, C., Kawecki, D., & Jones, D. (2002). Form 990 exempt organizations. Retrieved from https://www.irs.gov/pub/irs-tege/eotopicg02.pdf. Accessed July 2018.

- CICA (Canadian Institute of Chartered Accountants). (2013a). Applying standards specific to public sector NFPOs. https://www.cica.ca/applying-the-standards/financial-reporting/accounting-standards-for-not-for-profit-organizations/item73291.aspx. Accessed July 2018.

- CICA. (2013b). Applying standards specific to private sector NFPOs. https://www.cica.ca/applying-the-standards/financial-reporting/accounting-standards-for-not-for-profit-organizations/item73096.aspx. Accessed July 2018.

- CIMA (Chartered Institute of Management Accountants). (2009). IFRS and the public sector (Topic Gateway Series No. 58).

- Connolly, C., & Dhanani, A. (2009). Narrative reporting by UK Charities, Research Report 109. London: Association of Chartered Certified Accountants.

- Connolly, C., Hyndman, N., & McConville, D. (2013). Conversion ratios, efficiency and obfuscation: A study of the impact of changed UK charity accounting requirements on external stakeholders. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations,24(3), 785–804. ArticleGoogle Scholar

- Coomber, R. (1997, June). Using the Internet for survey research. Sociological research online. http://www.socresonline.org.uk/2/2/2.html. Accessed July 2018.

- Cooper, D. J., & Robson, K. (2006). Accounting, professions and regulation: Locating sites of professionalisation. Accounting Organisations and Society,31, 415–444. ArticleGoogle Scholar

- Cordery, C. J. (2013). Regulating small and medium charities: Does it improve transparency and accountability? VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations,24(3), 831–851. ArticleGoogle Scholar

- Cordery, C. J., & Deguchi, M. (2017). Charity registration and reporting: A cross-jurisdictional and theoretical analysis of regulatory impact. Public Management Review, 20(9), 1332–1352. https://doi.org/10.1080/14719037.2017.1383717. ArticleGoogle Scholar

- Cordery, C. J., Fowler, C. J., & Morgan, G. G. (2016). The development of incorporated structures for charities: A 100-year comparison of the England and New Zealand. Accounting History,21(2–3), 281–303. ArticleGoogle Scholar

- Cordery, C. J., Sim, D., & van Zijl, T. (2017). Differentiated regulation: The case of charities. Accounting and Finance,57(1), 131–164. ArticleGoogle Scholar

- Cordery, C. J., & Simpkins, K. (2016). Financial reporting standards for the public sector: New Zealand’s 21st-century experience. Public Money and Management,36(3), 209–218. ArticleGoogle Scholar

- Craig, R., Taonui, R., & Wild, S. (2012). The concept of taonga in Maori culture: insights for accounting. Accounting, Auditing & Accountability Journal,25(6), 1025–1047. ArticleGoogle Scholar

- Crawford, L. (2016). Moral legitimacy: The struggle of homeopathy in the NHS. Bioethics,30(2), 85–95. ArticleGoogle Scholar

- Crawford, L., Dunne, T., Hannah, G., & Stevenson, L. (2009). An exploration of Scottish Charities’ governance and accountability. Edinburgh: The Institute of Chartered Accountants of Scotland. Google Scholar

- Crawford, L., Helliar, C. V., Monk, E. A., & Veneziani, M. (2014a). International accounting education standards board: Organisational legitimacy within the field of professional accountancy education. Accounting Forum,38(1), 67–89. ArticleGoogle Scholar

- Crawford, L., Morgan, G. G., Cordery, C. J., & Breen, O. B. (2014b). International financial reporting for the not-for-profit sector: a study commissioned by the CCAB - Final Report. London: CCAB.

- Crawford, L., Helliar, C. V., & Power, D. M. (2016). The temporal nature of legitimation: the case of IFRS8. Accounting in Europe,13(1), 43–64. https://doi.org/10.1080/17449480.2016.1160136. ArticleGoogle Scholar

- Crawford, L., Morgan, G., & Cordery, C. J. (2018). Accountability and not-for-profit organisations: Implications for developing international financial reporting standards. Financial Accountability & Management,34(2), 181–205. https://doi.org/10.1111/faam.12146. ArticleGoogle Scholar

- Davies, N. (2012). CFG Symposium: Is there a need for an international accounting standard for not-for-profits?http://www.cfg.org.uk/Policy/finance-and-accounting/~/media/Files/Policy/Finance%20and%20Accounting/What_is_different_about_not-for-profit.ashx. Accessed July 2018.

- Davies, N., & Anderson L. (2018). Should public benefit be the focus of charity accounts? Civil Society Voices. https://www.civilsociety.co.uk/voices/nigel-davies-and-laura-anderson-should-public-benefit-be-the-focus-of-charity-accounts.html. Accessed July 2018.

- Dellaportas, S., Langton, J., & West, B. (2012). Governance and accountability in Australian charitable organisations: Perceptions from CFOs. International Journal of Accounting and Information Management,20(3), 238–254. ArticleGoogle Scholar

- Dhanani, A., & Connolly, C. (2012). Discharging not-for profit accountability: UK charities and public discourse. Accounting, Auditing and Accountability Journal,25(7), 1140–1169. ArticleGoogle Scholar

- Durocher, S., Fortin, A., & Cote, L. (2007). Users’ participation in the accounting standard-setting process: A theory-building study. Accounting, Organizations and Society,32, 29–59. ArticleGoogle Scholar

- Ebrahim, A. (2005). Accountability myopia: Losing sight of organizational learning. Nonprofit and Voluntary Sector Quarterly,34(1), 56–87. ArticleGoogle Scholar

- Ebrahim, A. (2009). Placing the normative logics of accountability in ‘thick’ perspective. American Behavioural Scientist,52(6), 885–904. ArticleGoogle Scholar

- European Commission. (2013). Report from the Commission to the Council and the European Parliament: Towards implementing harmonised public sector accounting standards in Member States. The suitability of IPSAS for the Member States. Brussels. Retrieved from http://epp.eurostat.ec.europa.eu/portal/page/portal/government_finance_statistics/documents/1_EN_ACT_part1_v5.pdf. Accessed July 2018.

- External Reporting Board. (2011). Accounting standards framework: A multi standards approach.

- Foundation, I. F. R. S. (2016). Trustees’ review of structure and effectiveness: Feedback statement on the July 2015 request for views, July 2016. London: IFRS Foundation. Google Scholar

- Georgiou, O., & Jack, L. (2011). In pursuit of legitimacy: A history behind fair value accounting. The British Accounting Review,43, 311–323. ArticleGoogle Scholar

- Gray, R., Bebbington, J., & Collison, D. (2006). NGOs, civil society and accountability: Making the people accountable to capital. Accounting, Auditing and Accountability Journal,19(3), 319–348. ArticleGoogle Scholar

- Hyndman, N. (1990). Charity Accounting—An empirical study of the information needs of contributors to UK fund raising charities. Financial Accountability & Management,6(4), 295–307. ArticleGoogle Scholar

- IASB. (2010). Conceptual framework for financial reporting. http://eifrs.ifrs.org/eifrs/PdfAlone?id=19274&sidebarOption=UnaccompaniedConceptual. Accessed July, 2018.

- IFRS. (2018). Who uses IFRS standards?https://www.ifrs.org/use-around-the-world/use-of-ifrs-standards-by-jurisdiction/#analysis. Accessed July, 2018.

- IPSASB (2016). International Public Sector Accounting Standards Board Factsheet, June 2016. https://www.ifac.org/system/files/uploads/IPSASB/IPSASB-Fact-Sheet-June-2016-2.pdf. Accessed February, 2018.

- Jetty, J., & Beattie, V. (2009). Disclosure practices of UK charities, Research Report 108. London: Association of Chartered Certified Accountants.

- Keating, E. K., & Frumkin, P. (2003). Reengineering nonprofit financial accountability: Toward a more reliable foundation for regulation. Public Administration Review,63(1), 3–15. ArticleGoogle Scholar

- Kevin Simpkins Advisory Services Ltd. (2006). A review of the policy of sector-neutral accounting standard-setting in Australia: Report to Australian Financial Reporting Council. New Zealand: Wellington. Google Scholar

- Khumawala, S. B., & Gordon, T. P. (1997). Bridging the Credibility of GAAP: Individual donors and the new accounting standards for nonprofit organizations. Accounting Horizons,11(3), 45–68. Google Scholar

- Kilcullen, L., Hancock, P., & Izan, H. Y. (2007). User requirements for not-for-profit entity financial reporting: An international comparison. Australian Accounting Review,17(1), 26–37. ArticleGoogle Scholar

- Laughlin, R. (2008). A conceptual framework for accounting for public-benefit entities. Public Money & Management,28(4), 247–254. ArticleGoogle Scholar

- Lehman, G. (2007). The accountability of NGOs in civil society and its public spheres. Critical Perspectives on Accounting,18(6), 645–669. ArticleGoogle Scholar

- Lennard, A. (2007). Stewardship and the objectives of financial statements: A comment on IASB’s preliminary views on an improved conceptual framework for financial reporting: The objective of financial reporting and qualitative characteristics of decision-useful financial reporting. Accounting in Europe,4(1), 51–66. ArticleGoogle Scholar

- Mango. (2015). Breakthrough in developing international financial standards for the not for profit sector. Retrieved from https://www.mango.org.uk/Pool/S-Standards-seminars-press-release-FINAL.pdf. Accessed July 2018.

- Morgan, G., & Fletcher, N. J. (2013). Mandatory public benefit as a basis for charity accountability: Findings from England and Wales. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations,24(3), 805–830. ArticleGoogle Scholar

- Müller, K. (2003). Swiss GAAP FER 21: Accounting standard for charitable, social non-profit organizations—The days after coming into force. International Society of Civil Society Law,1(4), 27–36. Google Scholar

- O’Dwyer, B., Owen, D., & Unerman, J. (2011). Seeking legitimacy for new assurance forms: The case of assurance on sustainability reporting. Accounting, Organisations and Society,36, 31–52. ArticleGoogle Scholar

- Paccagnella, L. (1997, June). Getting the seat of your pants dirty: Strategies for ethnographic research on virtual communities. Journal of Computer Mediated Communication. http://www.ascusc.org/jcmc/vol3/issue1/paccagnella.html.

- Reheul, A.-M., Caneghem, T., & Verbruggen, S. (2014). Financial reporting lags in the non-profit sector: An empirical analysis. VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations,25(2), 352–377. ArticleGoogle Scholar

- Rossouw, C. (2007). Does The GAAP-shoe fit not-for-profit organisations or is it causing them blisters? Journal of Economic and Financial Sciences,1(1), 21–37. Google Scholar

- Ryan, C., Mack, J., Tooley, S., & Irvine, H. (2014). Do not-for-profits need their own conceptual framework? Financial Accountability & Management,30(4), 383–402. ArticleGoogle Scholar

- Sanders, J., O’Brien, M., Tennant, M., Sokolowski, S. W., & Salamon, L. M. (2008). The New Zealand non-profit sector in comparative perspective. Wellington: Office for the Community and Voluntary Sector. Google Scholar

- Sills, S., & Song, C. (2002). Innovations in survey research: An application of web-based surveys. Social Science Computer Review,20(1), 22–30. ArticleGoogle Scholar

- Sinclair, R., & Bolt, R. (2013). Third sector accounting standard setting: Do third sector stakeholders have voice? VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations,24(3), 760–784. ArticleGoogle Scholar

- Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Review,20(3), 571–610. ArticleGoogle Scholar

- Thompson, L. F., Surface, E. A., Martin, D. L., & Sanders, M. G. (2003). From paper to pixels: Moving personnel surveys to the Web. Personnel Psychology,56(1), 197–227. ArticleGoogle Scholar

- Unerman, J., & O’Dwyer, B. (2006). On James Bond and the importance of NGO accountability. Accounting, Auditing & Accountability Journal,19(3), 305–318. ArticleGoogle Scholar

- University of Bristol. (2013). Bristol on-line surveys (BOS)—Introduction.https://www.survey.bris.ac.uk. Accessed Febuary, 2014.

- Valentinov, V. (2011). Accountability and the public interest in the non-profit sector: A conceptual framework. Financial Accountability and Management,27(1), 32–42. ArticleGoogle Scholar

- Witmer, D. F., Colman, R. W., & Katzman, S. L. (1999). From paper-and-pencil to screen-and-keyboard: Toward a methodology for survey research on the Internet. In S. Jones (Ed.), Doing internet research: Critical issues and methods for examining the net (pp. 145–161). Thousand Oaks, CA: Sage. ChapterGoogle Scholar

- Wright, K. B. (2005). Researching internet-based populations: Advantages and disadvantages of online survey research, online questionnaire authoring software packages, and web survey services. Journal of Computer-Mediated Communication,10, 00. https://doi.org/10.1111/j.1083-6101.2005.tb00259.x. ArticleGoogle Scholar

Acknowledgements

The study reported in this paper was commissioned by CCAB whose membership comprises five major chartered accountancy bodies—ICAEW, ACCA, CIPFA, ICAS and Chartered Accountants Ireland. However, all conclusions in this paper are the authors’ own. The study was undertaken while Carolyn Cordery was at the University of Victoria, Wellington and Louise Crawford was at the University of Dundee, the latter provided the technical facilities for the online survey. Other members of the research team who contributed include Faisal Sheikh and Liafisu Yekini (Sheffield Hallam University); Ruth Kelly and Suyanto Suyanto (University of Dundee). The authors also wish to thank participants at several conferences for helpful feedback especially the ISTR Conference in Muenster, Germany in July 2014 and thanks to ICAS for facilitating a summit of the four authors in Edinburgh, Scotland in October 2016.

Author information

Authors and Affiliations

- Sutherland School of Law, University College Dublin, Belfield, Dublin 4, Ireland Oonagh B. Breen

- Aston University, Birmingham, England, UK Carolyn J. Cordery

- Newcastle University Business School, Newcastle upon Tyne, England, UK Louise Crawford

- Sheffield Hallam University, Sheffield, England, UK Gareth G. Morgan

- Oonagh B. Breen